Credit score is the very first thing that the individual lenders or financial institutions check before sanctioning any loan. The 3-digit number acts as a major factor of one’s creditworthiness. Needless to say, poor credit score and history can be the deterring factors for an outright rejection of a mortgage loan. Moreover, the poorer the credit rating, the more the interest is.

In such a situation, a Toronto mortgage broker usually helps his clients to do away with the conundrum. However, it is highly recommended for people to have a solid credit score for increasing their chances of approval.

Do you have a poor credit history? Well, fret not! You need to implement a few steps before it goes beyond redemption. Here comes the list of a few effective tips from an expert Toronto mortgage broker to improve your rating within due time. Read on:

Have a Debt Repayment Plan

Late payments or missed payments are one of the most common reasons that break people’s credit score. However, you can still fix this issue by preparing a debt repayment plan. Paying the bills and interests timely eases the entire process. You may take the aid of a debt repayment plan to get started.

Check Your Credit Report

You must check your credit report at a certain interval as small inaccuracies can result in disastrous results. For instance, a misspelled name or any incorrect information can bog down your score straight away. So, it is of utmost importance to verify all the details and if you spot any errors, contact the bureau to do the necessary corrections.

Avoid Multiple Applications at the Same Time

Applying for multiple loans at the same tenure can hurt your credit score to a good extent. Moreover, lenders will also consider you to be a credit hungry person. This, in turn, will make the process of availing a loan difficult. So, during any sort of financial discrepancy, be calculative and apply carefully. You can always contact a Toronto mortgage broker for proper guidance.

Don’t Close Unused Accounts

Closing old accounts and credit cards decrease the score. It is always recommended to keep the unused accounts open, especially if they don’t cost you any extra fees. This is indeed a smart hack to make your score above 730 after a certain period.

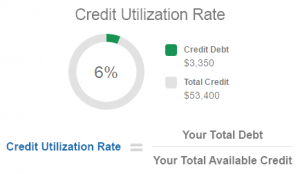

Work on Credit Utilization Ratio

According to any Toronto mortgage broker, credit utilization ratio is a significant factor for having a strong credit score. In order to fix your score as early as possible, you must maintain the debt to income ratio below 30 per cent.

Retain a Low Outstanding Balance

In relation to the earlier point, this aspect is self-explanatory. You must try and maintain a low outstanding balance in comparison to the borrowing cap. Keep your credit limit below 75 per cent to improve your score.

Pinpoint on these factors to amend your credit score at par. However, don’t expect an immediate result. In the meanwhile, if you are in dire need of an external source of finance, talk to a professional Toronto mortgage broker. He might help you to avail a loan at a competitive interest rate. To find more info about Toronto mortgage broker read this article!